ON HOW TO MAP OUT IDEATION ACTIVITY WITHIN THE FIRM…

“Innovation always is about individuals and their formal and informal relationships”

Companies that want to sail a different wind, typically have an improvement in mind. And whether this improvement is now a bare necessity – things do not go well, things must change – or rather originates from an ambition to innovate, in both cases, it comes down to rendering ideas to make things work for the better. Only if you know where and whom those ideas within the organization originate from and how they spread, management can actually redeem their potential. An analysis of the organizational network can help to show if ‘something’ or ‘nothing’ happens to unearth new insights to the benefit of the company, and also when it comes to getting these ideas dispersed in and adapted by the company.

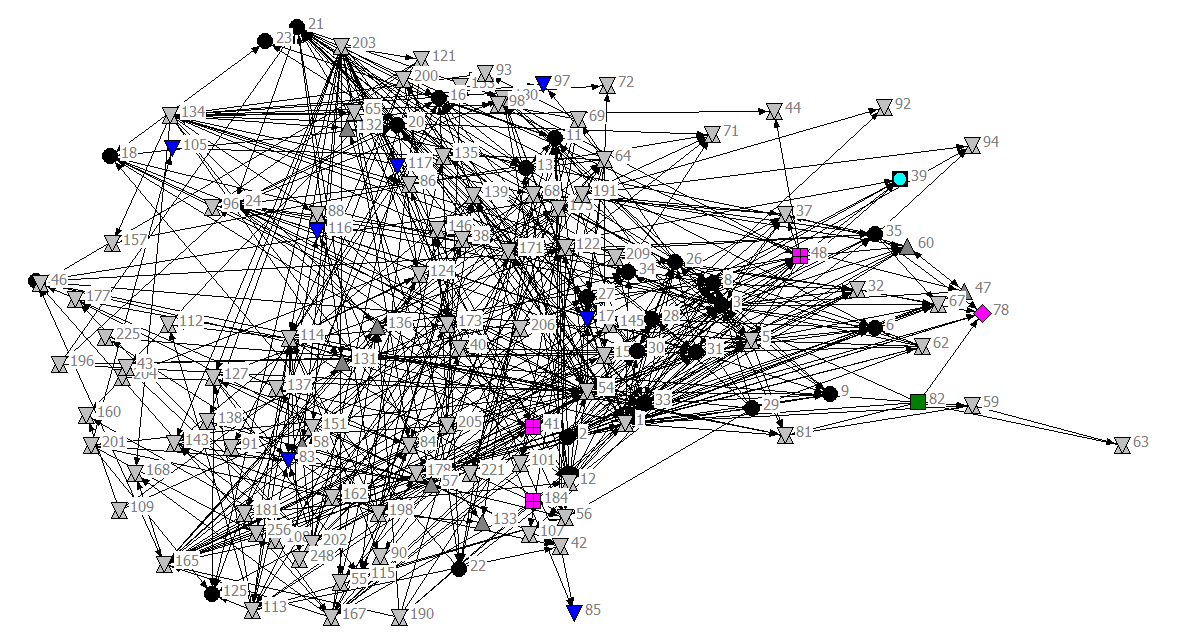

Organizational network analysis (ONA) is a systematic approach and set of techniques for studying the connections and resource flows between people, teams, departments and even whole organizations. The underlying idea is that employees and their interactions can be seen as nodes and links that allow for both visual and mathematical illustration. Organizations can be approached as a set of communication networks as much as they are a bundle of resources or contracts, and people in a firm exchange information and knowledge of many different kinds with each other. Some of it may be irrelevant to the firm’s performance, but even so communication can help people form closer connections which can help them get their job done.

Through organizational network analytics, managers can gain a bird’s-eye view of existing network structures and communication patterns, which are often in stark contrast to what they believe them to be or how they would like them to function. Who are connected to each other? How often do they interact? About what?

“The greatest value of a picture is when it forces us

to notice what we never expected to see.”

– John Tukey, 1977

In management settings, organizational network analysis has been effective at providing leaders with insights to help diagnose and solve the problems that often hamper important collective-process outcomes such as organizational structure, decision making, performance and innovation.

The degree to which organizations are able to reap the benefits of the social capital represented by the networks, depends to a large extent to the degree to which resources can be accessed and mobilized through them. While the potential of leveraging an organization’s networks to render innovative activity can be substantial, the barriers faced within the organization to do so can be equally large. Organizational boundaries, such as organizational divides between different functional or operational domains, business units, are hurdles for the free flow of knowledge inside the organization. Management can and must understand the connections present in a firm before it starts any form of intervention to boost innovative activity within or across a business unit, for instance. Actual innovation contacts can be more difficult to find. The formal contacts are most visible, and the informal ones can be relatively easily uncovered. The latter two also help management find and nourish the innovation sweet spot. Insights in individual differences, and the rationale behind these differences are a first step in assessing the ideation climate of an organization.

Connections among people and the overall network configuration should be what a manager who minds a company’s long-run success keeps in view. Organization network analysis can be of help to identify idea connectors, for instance: those individuals that are core to getting others together around a new idea, establishing a buzz around new ideas and to attracting genuine managerial attention. The underlying analytics can help to assess if there are parts of the internal network to which their ties do not extend, for instance. Knowing of such omissions, management as well as employees themselves, can take the necessary steps to remedy them.

Ongoing ideation is a necessity. So are the analytics to take pulse of its presence. On that note, here is some prior work on the “collaboration for innovation” theme – for those interested in the phenomenon – that I engaged in over the past decade:

- Aalbers R., Huisman, M, McCarthy, K., & Roettger, J. (2022). Moving Motives: How Past and Present Strategy Influence the Market”. PLosONE,, forthcoming

- Aalbers R., Mccarthy, K. & Heimeriks, K. (2021) Market Reactions to Acquisition Announcements: The Importance of Signaling ‘Why’ and ‘Where’”. Long Range Planning, https://doi.org/10.1016/j.lrp.2021.102105

- Katoh, S., R Aalbers, S Sengoku (2021) Effects and Interactions of Researcher’s Motivation and Personality in Promoting Interdisciplinary and Transdisciplinary Research, Sustainability 13 (https://doi.org/10.3390/su132212502)

- Aalbers, R. , E Whelan (2021) Implementing Digitally Enabled Collaborative Innovation: A Case Study of Online and Offline Interaction in the German Automotive Industry, Creativity and Innovation Management, https://doi.org/10.1111/caim.12437

- Rueger, J., Dolfsma, W & Aalbers, R. (2020). Perception of Peer Advice in Online Health Communities: Access to Lay Expertise, Social Science and Medicine.

- Aalbers, R, & Dolfsma, W.A. (2019). Resilience of information flow during restructuring: Characterizing information value being exchanged and the structure of a network under turmoil, Journal of Business Research, 100(7), 299-310.

- McCarthy, and Aalbers, H.L. (2017) Technological Acquisitions: The Impact of Geography on Post-Acquisition Innovation Performance, Research Policy, 90(4), 137-145

- Dolfsma, Midavaine, J. & Aalbers, H.L. (2016). Board Diversity and R&D Investment. Management Decision, 54 (3)

- Aalbers, L., Whelan, E., Parise, S., & Vialle, C. (2016). The Perils of Democratic Decision Making. Ivey Business Journal, Jan/Feb issue.

- Aalbers, L., Dolfsma, W. & Leenders, R.Th.A.J. (2016). Vertical and Horizontal Cross-Ties: Benefits of Cross-Hierarchy and Cross-Unit Ties for Innovative Project Teams. Journal of Product Innovation Management, 33(2), 141-153.

Also some events hosted on the matter over the years, such as the:

- Symposium digital entrepreneurship in the financial sector November , 2021

This symposium was organized in collaboration with Our IMR Centre for Organization Restruturing and Atos France (headquarters). The focus was on the importance and challenges of entrepreneurship using digital technologies, and the role played by policy-makers and large organizations in fostering new financial ventures. On the day after the symposium, the FINDER PhD students and their academic supervisors had one-on-one meetings with the Atos departments responsible for connecting the outcome of the conference to the individual research projects of the students.

- Strategic Management Society Special Conference in Berkeley – Professional development workshop on the strategic management of social networks, November 5th, 2020

Related to the Collaboration for Innovation theme I work on with several of my PhD students I was granted the opportunity to organize a professional development workshop as part of the Strategic Management Society Special Conference in Berkeley (USA) “Designing the Future: Strategy, Technology, and Society in the 4th Industrial Revolution”, which was set to take place in March 2020. PhD students presented their research to previously assigned scholars in dedicated break-out sessions (to cover the workshop aspect of the initial design). The participating panelists were Dr. Fleur Deken (VU), Dr. Yulia Snihur (Toulouse Business School), Koen Heimeriks (University of Warwick), Dr. Saeed Khanagha (VU), Dr. Martin Friesl (University Bamberg), Rick Aalbers (Radboud University), Dr. Sotirios Paroutis (University of Warwick) and Sebastian Schäfer (TechQuartier and lecturer at Goethe Business School).

- Symposium Inclusive Digital Innovation in the Financial Services aka Inclusive digital innovation event week March 15th – 18th, 2021

This symposium consisted of five one-hour sessions on five topics revolving around digital innovation in the financial services. Various expert panelist we pulled together here for group level phd discussion purposes, in a format that abridged practitioners and early stage researchers, as listed below per discussion theme:

- How to de-risk corporate-startup innovations while improving speed and cost? Josemaria Siota, Executive Director IESE Business School, explained how to engage in venturing as a corporation by pulling from his latest research report (available here). The session was facilitated by Nikhil Chouguley, Global Head of Product Governance & ESG Oversight at Deutsche Bank. Click here for a summary of the session. and GAIA-X: The future of the European data cloud by Hubert Tardieu, Chairman of the Board of the GAIA-X AISBL, introduced the European business to business data sharing initiative GAIA-X. Click here for a summary of the session.

- Research Excellence Workshop at Atos Amstelveen, February 10th and 11th, 2020

Together with the fintech hub at Atos I organized a two day Research Excellence Workshop in close collaboration with Atos. The workshop, focused on advanced methodologies and research publication strategies, aimed to increase the knowledge of the participants on qualitative and quantitative research methods at advanced levels. Attending students represented universities such as Radboud University, VU Amsterdam, University and Research Wageningen, RijksUniversiteit Groningen, Tilburg University, Universiteit Hasselt, National University of Ireland Galway.

- Organizer of Start up weekend – October 2021

This was a public event to help start-up entrepreneurs with creative ideas for digital entrepreneurship start their innovation journey. This two-day event provided for a platformon early stage start up profiling, while at the same time it will offer an excellent opportunity for the continuation of the accomplished research by a larger group of researchers and professionals. Participants included from 3 continents, incl. UK, German, Nepali and Nigerian based inclusive finance fintech startups.

- Organizer of the EGOS Colloquium Sub-theme: Collaboration and the (Ir)Rationalities of Decision-making in a Digital Landscape – 8+9 July 2021

This sub-theme pivots around the question how digital technologies influence systems, practices and processes for inclusive decision making within and across organizations, exploring the (ir)rationalities of decision making in a digital landscape as organizations experiment with new ways of organizing EGOS – SUB-THEMES [main Colloquium] – European Group for Organizational Studies (egosnet.org)

- Symposium digital entrepreneurship in the financial sector

This symposium was organized in collaboration with Our IMR Centre for Organization Restructuring and Atos France (headquarters). The focus was on the importance and challenges of entrepreneurship using digital technologies, and the role played by policy-makers and large organizations in fostering new financial ventures.

- Fintech training and community building event in Frankfurt, Germany, April 8th and 9th, 2019

A two day training event I organized in collaboration with Atos Germany and TechQuartier aiming to introduce a multinational and interdisciplinary group to each other. PhD students and academics of amongst others VU Amsterdam and KU Leuven on the one hand, and prominent corporations on the other hand: Atos (a global leader in digital transformation and European number one in Cloud, Cybersecurity and High-Performance Computing) and TechQuartier (a cross-industry innovation platform created to bring startups, corporates and new talent together to work, meet, learn and collaborate on new technologies and digital business models). Topics of discussion included (amongst others) reflection on research and community building opportunity, insight in the Frankfurt eco system and various case studies, e.g. Komuno (Helaba spin-off) know both worlds (presented by Robert Wassmer), Deutsche Börse Venture network (presented by Peter Fricke), Creditlinks – participation of both Papillon & Compliance Navigator (presented by Tilo Kraus) and Trends in Fintech: the future of digital twinning (presented by S. James Ellis).